To find affordable SR22 insurance rates in Tennessee, it is vital to shop around and compare quotes from multiple insurance providers - certificate of insurance.

To find affordable SR22 insurance rates in Tennessee, it is vital to shop around and compare quotes from multiple insurance providers - certificate of insurance. You're likely to face SR22 penalties, such as higher premiums, due to the high-risk nature of this insurance. However, you can mitigate these costs by seeking insurance discounts. Many providers offer discounts for drivers who complete defensive driving courses, install anti-theft devices, or have a good driving reco

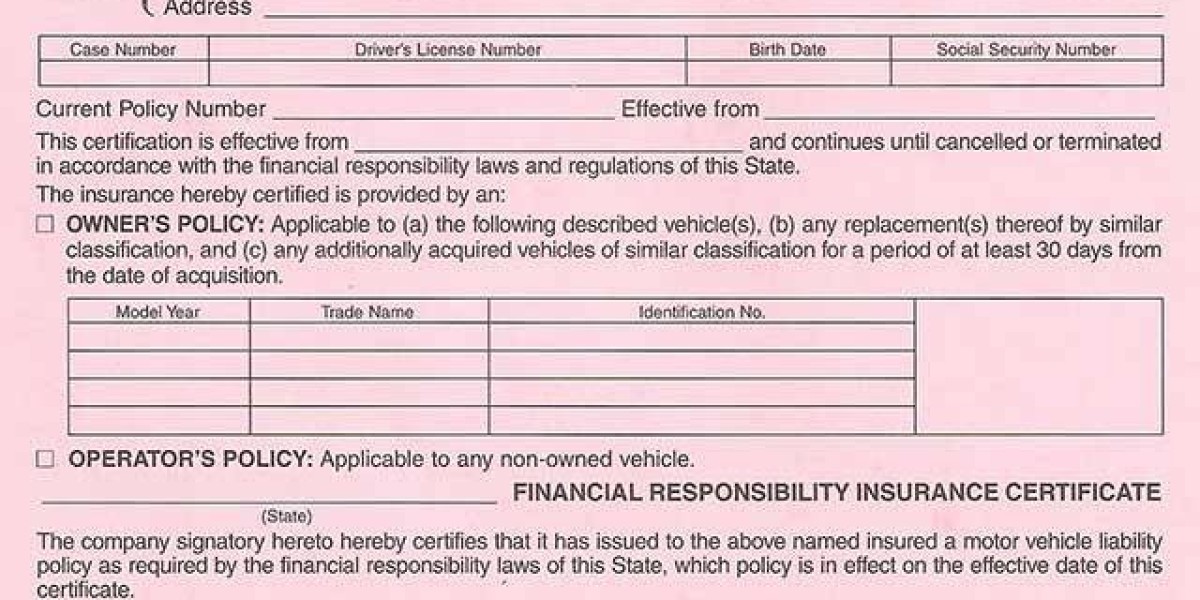

Because you're likely looking for cheap SR22 insurance in Tennessee, it's vital to understand what SR22 requirements entail. You'll need to file SR22 forms - SR22 insurance filing in Tennessee with the state, which verifies that you have the necessary insurance coverage. This requirement is usually mandatory after a driving offense, such as a DUI or reckless driving. You must comply with state regulations, which dictate the minimum liability insurance you need to car

You're checking SR22 coverage, which typically has limitations, and you'll find it usually doesn't cover other drivers, so you're responsible for ensuring they have proper insurance to operate your vehicle safely. How to get SR22 insurance in T

You should research insurance providers that offer SR22 filings, as not all companies provide this service - certificate of insurance. When comparing providers, consider factors such as cost, coverage options, and customer service. Some insurance providers specialize in high-risk auto insurance, so it's worth exploring these options. By understanding the SR22 process and working with a qualified insurance provider, you can guarantee you have the necessary coverage to get back on the road safely. This will help you meet the state's requirements and maintain your driving privileg

Because you're likely looking for cheap SR22 insurance in Tennessee, it's vital to understand what SR22 requirements entail. You'll need to file SR22 forms - SR22 insurance filing in Tennessee with the state, which verifies that you have the necessary insurance coverage. This requirement is usually mandatory after a driving offense, such as a DUI or reckless driving. You must comply with state regulations, which dictate the minimum liability insurance you need to car

Insurers in Tennessee offer premium discounts that can markedly cut your SR22 insurance rates. You can take advantage of these discounts to reduce your financial burden. By doing so, you'll be able to allocate your resources more efficiently, guaranteeing you're getting the best value for your mone

Finding the right SR22 insurance policy is just the first step - now it's time to focus on saving money on premiums (certificate of insurance). You'll want to investigate premium discounts that can lower your rates. One way to do this is by maintaining a clean driving record. If you've had a DUI or other serious offense, it may take some time to rebuild your record, but it's worth the effort. You can also consider taking a defensive driving course to demonstrate your commitment to safe

You hold the key, releasing SR22 validity, as you traverse interstate insurance, verifying its acceptance across state lines to guarantee seamless coverage, safeguarding your financial security (

Sr22 Insurance Experts Tn). (certificate of insuranc

You're considering SR22 cancellation, but you must complete the SR22 renewal timeline, typically 3 years, before initiating the SR22 cancellation process, ensuring compliance and avoiding penalties. -

SR22 insurance TN insurance filing in Tenness

Research multiple insurance providers for

SR22 insurance TN.

Compare rate quotes for best coverage options.

Maintain a clean driving record for discounts. Bundle policies for reduced premium costs.

Install safety devices for lower insurance rate

SR22 insurance is required for high-risk drivers in TN.

Minimum liability coverage is $25,000 bodily injury per person.

Higher premiums are expected due to SR22 penalties.

Shopping around helps find affordable SR22 rates.

Discounts are available for defensive driving course

Your need for speedy SR22 insurance doesn't have to delay your plans - you can get insured quickly by following a few simple steps. You'll need to find an insurance provider that offers fast approval and quick coverage. Many insurance companies in Tennessee offer online quote systems, allowing you to compare rates and coverage options from the comfort of your own home. By providing the necessary information, you can get approved for SR22 insurance in no tim

You can also contact insurance providers directly to ask about their SR22 insurance policies and procedures. They'll guide you through the process, ensuring you get the coverage you need quickly - SR22 Insurance Solutions Tennessee. With fast approval, you can get back on the road without delay. Quick coverage means you'll be protected in case of an accident, giving you peace of mind while driving. By choosing the right insurance provider, you can get SR22 insurance fast and start driving safely aga

โปรโมชั่นเดิมพันฟุตบอลออนไลน์ที่น่าสนใจ

Descubra como os traços faciais revelam sua personalidade

Descubra como os traços faciais revelam sua personalidade

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

You'll Never Guess This Private Online Psychiatrist's Tricks

You'll Never Guess This Private Online Psychiatrist's Tricks

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!