Additionally, workers should rigorously consider the total price of the loan, together with any associated fees.

Additionally, workers should rigorously consider the total price of the loan, together with any associated fees. While employee loans could offer decrease interest rates, hidden charges can negate a few of those advantages. Employees should always ask for detailed documentation outlining the phrases of the loan to ensure transpare

No-visit Loans provide several advantages that attraction to a large audience. Firstly, the convenience issue cannot be overstated. Borrowers can apply at their convenience with out the want to schedule appointments or travel to a bank location. This feature is particularly advantageous for busy people and people residing in remote ar

Disadvantages to Consider

While Same-day Loans supply a quantity of benefits, there are also potential downsides. The most important concern is the high interest rates associated with these loans. Borrowers may find themselves in a precarious monetary situation if they can't repay the loan on time, leading to additional d

The absence of a physical assembly not solely saves time but in addition enhances the comfort factor for many customers. Individuals can apply for loans from the comfort of their homes at any time of the day. This flexibility suits various existence and obligations, making No-visit Loans a beautiful various to standard lo

However, it is important for debtors to understand the various varieties of No-visit Loans out there, similar to private loans, payday loans, and small business loans. Each kind comes with its own set of terms, rates of interest, and compensation schedules, necessitating knowledgeable decision-making for potential applica

Advantages of Same-day Loans

The main benefit of Same-day Loans is the velocity at which funds may be accessed. In many cases, borrowers can obtain cash on the same day, offering immediate aid for urgent bills. This quick turnaround could be invaluable when facing monetary emergenc

Yes, many lenders offering Same-day Loans do not require strict credit score checks, making them accessible for individuals with bad credit. However, the rates of interest could also be greater as a outcome of perceived danger. It's essential to read all phrases fastidiously earlier than apply

No-visit Loans allow borrowers to safe funds without needing to visit a bodily financial institution or financial establishment. This mannequin leverages digital expertise to streamline the mortgage application process, enabling users to submit their data on-line. The response time is typically sooner than conventional strategies, as the vast majority of the method could be managed remotely. With secure online portals and efficient processing systems, these loans have gotten a preferred selection for those in search of quick financial soluti

Once the applying is submitted, the lender will assess the knowledge to find out eligibility. Many lenders employ automated techniques that can present virtually instant suggestions on the applying standing. If accredited, the borrower might obtain the mortgage agreement, outlining the phrases, repayment schedule, and any associated char

In addition to lender comparisons, 베픽 additionally offers academic articles that break down the nuances of making use of for No-visit Loans. This accessible data empowers customers to know the borrowing course of better and make knowledgeable monetary selecti

One main attribute of month-to-month loans is that they come with fastened rates of interest, which means that the borrowing price is predictable every month. This stability might help borrowers budget successfully, as they'll know exactly how a lot they owe every month. However, debtors should be cautious of the interest rates utilized, as they will significantly have an result on the overall cost of the l

When to Use a

Loan for Unemployed Calculator

Using a mortgage calculator ought to be a foundational step earlier than committing to any mortgage. It's particularly beneficial during the early stages of researching loan choices when comparing varied lenders or mortgage merchand

Most mortgage calculators not only provide payment estimates but in addition break down how a lot of every fee goes toward curiosity versus the principal. This information is vital for understanding the long-term influence of taking out a mortgage. When considering large sums, such as mortgages or scholar loans, having a transparent picture of these figures can be the difference between a sound financial decision and unnecessary d

n

Emergency Loan calculators present estimates primarily based on the knowledge entered. They are useful for getting a common thought of

Monthly Payment Loan funds and whole curiosity, but they could not account for closing prices, fees, or adjustments in interest rates that can impact the ultimate quantity paid. Always consult with a monetary advisor for more precise calculati

Following submission, there could also be a quick evaluation interval throughout which the employer evaluations the applying. If permitted, employees will receive an in depth agreement outlining the loan's terms, together with repayment schedules, interest rates, and another related conditi

โปรโมชั่นเดิมพันฟุตบอลออนไลน์ที่น่าสนใจ

Descubra como os traços faciais revelam sua personalidade

Descubra como os traços faciais revelam sua personalidade

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

You'll Never Guess This Private Online Psychiatrist's Tricks

You'll Never Guess This Private Online Psychiatrist's Tricks

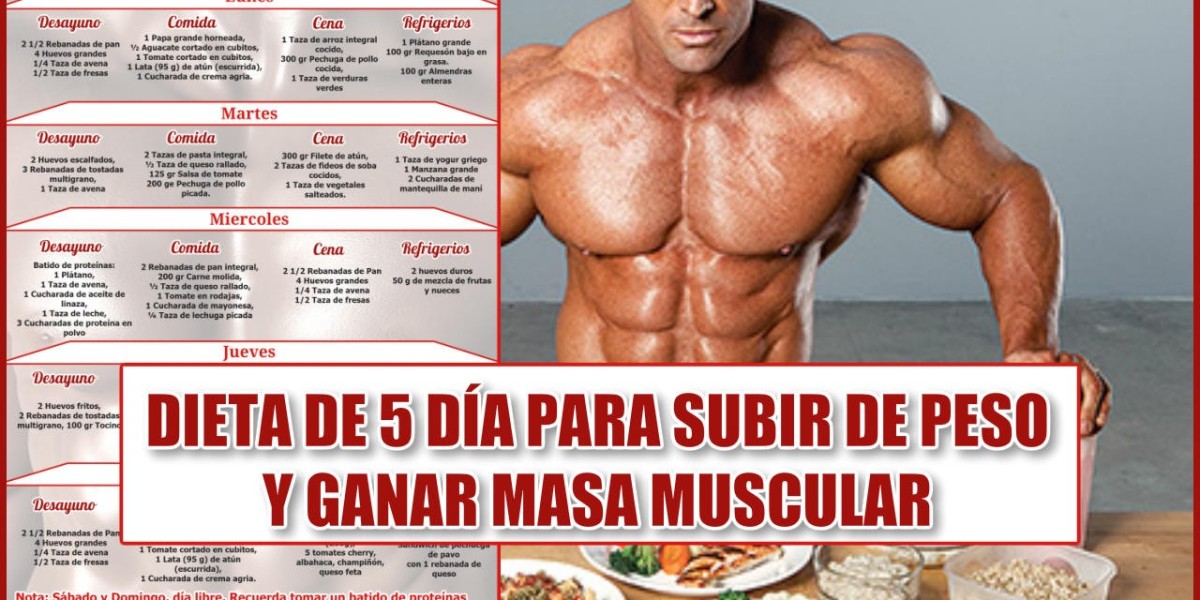

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!