The Application Process

Applying for a no-visit loan typically involves a straightforward online course of.

The Application Process

Applying for a no-visit loan typically involves a straightforward online course of. Prospective debtors can start by researching varied lenders to search out essentially the most suitable choices based on their specific needs and financial circumstances. Once a lender has been chosen, candidates should fill out an online utility form that usually requires primary private and monetary i

In addition to informative articles, 베픽 additionally provides a neighborhood forum the place people can share experiences and seek guidance from others dealing with related challenges. This collaborative aspect provides value by facilitating assist networks that encourage monetary restoration and stabil

Moreover, debtors ought to be wary of predatory lending practices. Not all lenders are respected, and

이지론 a few could impose hidden fees or excessively high-interest charges. Conducting thorough analysis and studying all associated documentation is vital to make sure the chosen loan aligns with one’s financial capabilit

In right now's financial panorama, many people face challenges securing loans as a end result of an absence of favorable credit score historical past. Credit-deficient loans have emerged as an answer for those grappling with such difficulties. This article explores the intricacies of credit-deficient loans, including what they're, their benefits, dangers, and important concerns for debtors. For detailed insights and critiques relating to credit-deficient loans, visiting the official BePick website can provide priceless ass

Borrowers have potential options for negotiating with debt collectors as nicely. Initiating communication with the collection agency can establish a mutually agreeable fee construction. It is important to approach these discussions armed with information and a transparent understanding of financial capabilit

If you encounter financial difficulties during the mortgage interval, don't hesitate to contact your lender. Many institutions provide options corresponding to payment deferrals or restructuring that can present short-term relief when facing hardsh

Another risk is the potential for predatory lending practices. Unscrupulous lenders would possibly target those in susceptible positions with exorbitant charges and terms that are difficult to satisfy. It’s crucial for debtors to conduct due diligence and choose respected lend

To ensure you secure a good auto mortgage, it’s important to have a good credit rating, a steady income, and a clear understanding of the loan phrases, including interest rates, charges, and compensation durati

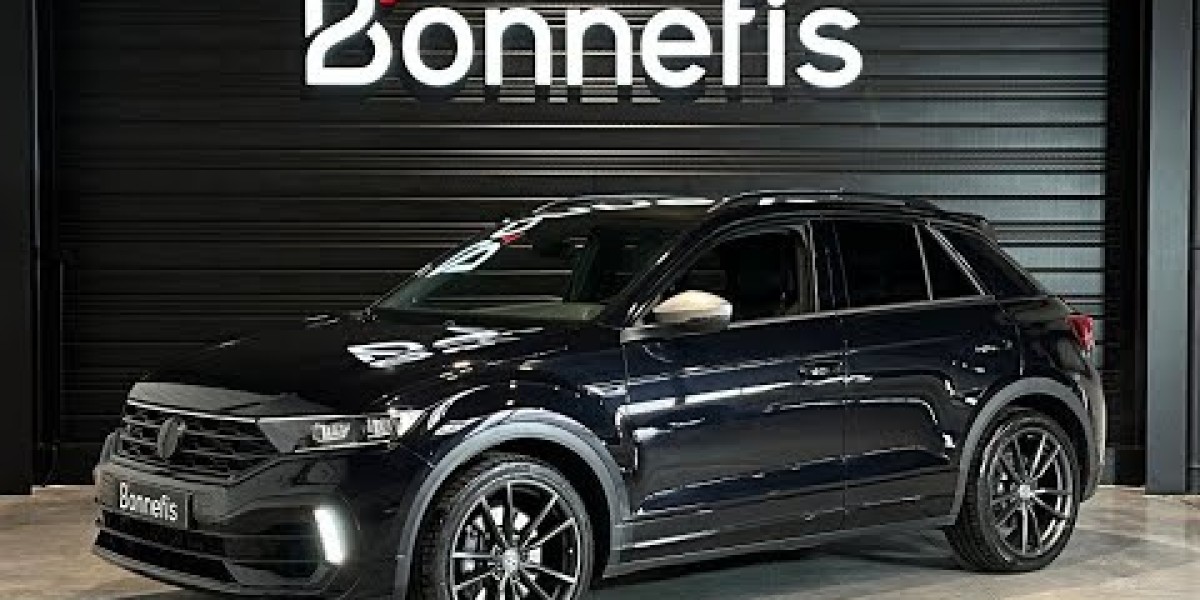

What is an Auto Loan?

An auto loan is a kind of financing that enables people to purchase a automobile. Basically, the lender offers a sum of money to the borrower, who agrees to repay this quantity, plus curiosity, over a particular period. Generally, these loans could be secured or unsecured, with secured loans usually requiring the vehicle as collate

Another significant benefit is the potential for decrease interest rates in comparison with conventional unsecured loans. Since the

Loan for Office Workers is collateralized, lenders could provide extra favorable terms, thus saving debtors money in interest payments over time. Furthermore, these loans might help people construct or enhance their credit scores if funds are made on t

Additionally, Freelancer Loans typically include competitive interest rates, tailored reimbursement plans, and manageable use of funds. This allows freelancers to put money into their business with out the worry of overwhelming debt. The capacity to entry quick funding can even allow freelancers to grab opportunities that won't have been possible without financial ass

Freelancer Loans can be utilized for a variety of purposes, together with buying gear, funding marketing campaigns, covering operational expenses, and even making personal investments in expertise improvement. The flexibility of these loans allows freelancers to deal with both immediate wants and long-term objecti

As a part of the choice course of, think about reaching out directly to potential lenders with questions on their products. A responsive and informative customer service method is indicative of a lender who values their shoppers and offers assist all through the borrowing proc

Finally, the broader economic surroundings can influence rates of interest. Changes made by the Federal Reserve or market situations could result in fluctuations in auto

Emergency Loan charges, so it’s wise to regulate economic tendencies and timing your mortgage software accordin

In addition to credit score rating implications, borrowers with delinquent loans might face increased interest rates if their accounts are despatched to collections. Understanding the pathways of debt recovery and exploring choices to rectify delinquent loans is important for maintaining monetary well be

Resources corresponding to BePick can prove invaluable in this process, offering insightful critiques and comparisons of different lenders. Reading testimonials and suggestions from different freelancers can also help make an informed decision and selecting a lender that understands the distinctive wants of freelanc

โปรโมชั่นเดิมพันฟุตบอลออนไลน์ที่น่าสนใจ

Descubra como os traços faciais revelam sua personalidade

Descubra como os traços faciais revelam sua personalidade

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

You'll Never Guess This Private Online Psychiatrist's Tricks

You'll Never Guess This Private Online Psychiatrist's Tricks

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!