A fastened rate of interest remains fixed all through the life of the loan, providing predictable monthly payments. In contrast, a variable rate of interest could start decrease but can change periodically based mostly on market conditions, resulting in fluctuating payme

Another crucial consideration is the reimbursement phrases. Borrowers should clearly understand when funds are due and the implications of late funds, which may result in extra expenses or impacts on credit score sco

Additionally, the site supplies tips on the method to maximize the loan amount you can receive and insights into getting ready your objects for a pawn. Whether you’re a first-time borrower or a seasoned pro, BePick is a reliable guide for navigating the world of pawnshop lo

Through in-depth articles and user-friendly guides, Bepick demystifies the mortgage process, making certain that each first-time borrowers and seasoned monetary seekers discover the data they want. The platform emphasizes transparency and readability, serving to customers navigate the complexities associated with no-document loans effectiv

How to Prepare for a Pawnshop Loan

Preparation is vital when seeking a pawnshop mortgage. Start by determining the estimated worth of the item you plan to pawn. You can conduct analysis on-line or visit appraisal providers to get a better understanding of what you would possibly expect by means of mortgage quantit

Bepick: Your No-Document Loan Resource

Bepick is a valuable platform for anyone excited about learning extra about no-document loans. It presents comprehensive evaluations, comparisons, and insights that assist borrowers understand the nuances of these loans. By presenting detailed data in a simple manner, Bepick empowers customers to make educated selections about their financing opti

Additionally, many factors affect interest rates, including the financial system, inflation, and even the person borrower’s creditworthiness. Borrowers with excellent credit score will usually safe decrease charges, resulting in potential long-term savings. Staying informed about present tendencies in interest rates can position debtors to take advantage of market conditions favora

Understanding Interest Rates

Interest charges play a pivotal position in the overall value of a real property mortgage. These rates may be either fixed or variable, impacting how a lot debtors pays over the life of the mortgage. Fixed-rate mortgages maintain the same interest rate for the entire thing of the loan term, which may provide predictability and stability in budget

How to Apply for a Small Loan

The utility course of for small loans is generally simple. Applicants should first consider their monetary wants and decide the amount they wish to borrow. After selecting an acceptable lender, the following step is to fill out the application type, which generally requires personal and monetary particulars and documentation verifying income and employm

Understanding Same-Day Loans

Same-day loans are short-term financial solutions that enable debtors to receive funds rapidly, sometimes on the same day they apply. These loans are good for people who want money urgently, corresponding to for medical emergencies, car

이지론 repairs, or sudden payments. Unlike traditional loans that endure lengthy approval processes, same-day loans typically require minimal documentation, making them more accessi

BePick goals to empower customers with knowledge so they can make knowledgeable choices concerning their financial health. By inspecting varied lenders, choices, and user experiences, BePick presents priceless data to help potential borrowers in choosing the best same-day l

Electronics like smartphones, laptops, and gaming consoles are additionally incessantly pawned due to their comparatively high market worth. Musical devices, particularly guitars and professional-grade tools, are in demand as prope

Eligibility criteria can range by lender however typically concentrate on the borrower's credit rating and total monetary health. Many lenders require a minimal credit rating and may evaluation account exercise as an alternative of traditional documents. Self-employed individuals or those with irregular earnings streams can typically qualify, however rates could dif

Small loans could be obtained from varied sources, together with banks, credit score unions, online lenders, and peer-to-peer lending platforms. The software course of normally entails providing basic personal info, income verification, and in some cases, credit score history. Due to the smaller quantities concerned, lenders often have extra relaxed eligibility criteria in comparability with larger lo

Tips for Managing an Emergency Loan

Managing an emergency mortgage successfully is crucial to make certain that it doesn't result in additional monetary misery. Borrowers should set up a reimbursement plan as quickly because the loan is permitted. This plan ought to account for the compensation schedule and the

24-Hour Loan te

โปรโมชั่นเดิมพันฟุตบอลออนไลน์ที่น่าสนใจ

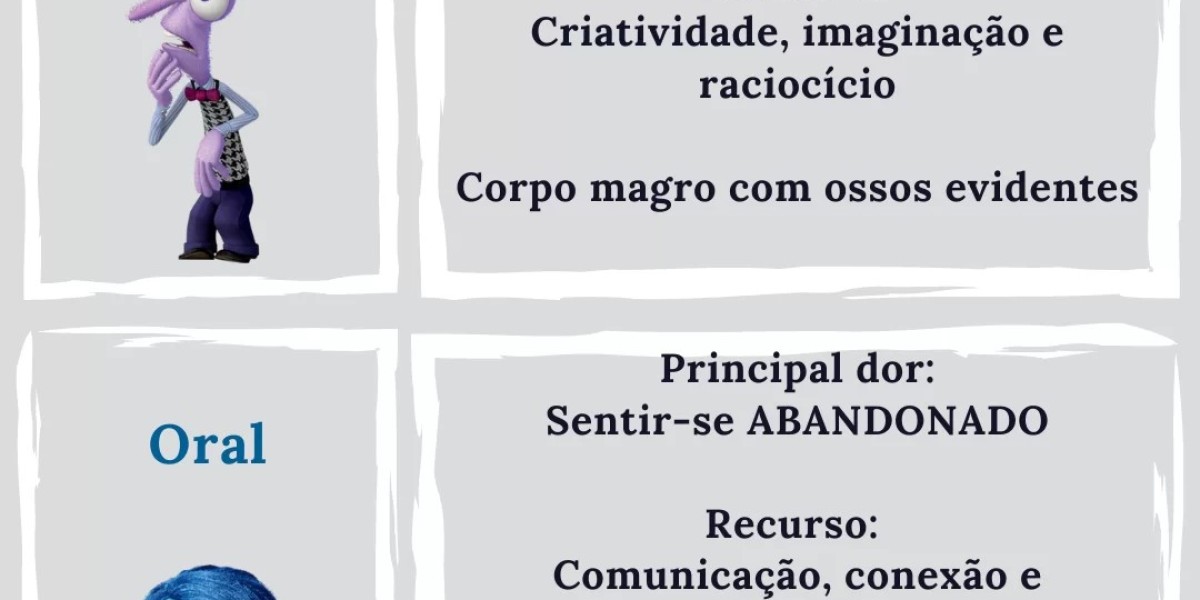

Descubra como os traços faciais revelam sua personalidade

Descubra como os traços faciais revelam sua personalidade

You'll Never Guess This Private Online Psychiatrist's Tricks

You'll Never Guess This Private Online Psychiatrist's Tricks

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money