BePick: Your Student Loan Resource

BePick is a priceless platform that gives in-depth data and evaluations concerning student loans.

BePick: Your Student Loan Resource

BePick is a priceless platform that gives in-depth data and evaluations concerning student loans. With a mission to empower debtors, BePick guides users through the customarily complicated world of student loans, helping them determine the most effective choices for his or her conditi

Most small loans are unsecured, which means the borrower doesn't need to pledge assets as collateral. This may be notably advantageous for people who don't own substantial possessions or are hesitant to danger their property. However, as a result of these loans are unsecured, lenders typically consider the borrower's creditworthiness rigorously. A solid credit score can increase the chances of approval and may have an result on the

Loan for Bankruptcy or Insolvency phrases offered.

Although small loans are often marketed to people with poorer credit, borrowing responsibly stays essent

The Impact of Delinquent Loans

The repercussions of delinquent loans may be far-reaching. For debtors, the immediate results embody a unfavorable impression on their credit score scores, making it exceedingly tough to secure future loans or considerably affecting their ability to purchase a house. A poor credit rating can lead to higher rates of interest on any loans they do finally secure, finally costing them more in the lengthy t

However, borrowing should only be considered after an evaluation of 1's financial state of affairs. For long-term financial targets or larger purchases, alternative financing options may be more useful. It remains crucial to judge if the monthly repayments match within your price range, making certain that reimbursement does not lead to further monetary hards

Employee Loan Repayment Processes

Facilitating a seamless compensation process is critical to the success of an Employee Loan program. Typically, repayments may be mechanically deducted from employee salaries, minimizing the risk of missed payme

The Application Process

The pupil loan utility process varies relying on the sort of

Business Loan. For federal loans, college students must complete the Free Application for Federal Student Aid (FAFSA). This form determines eligibility for monetary help and can open doors to numerous state and institutional grants, scholarships, and federal mortgage choi

The Impact of Student Loans on Financial Health

Student loans can have a profound impact on borrowers’ financial well-being lengthy after graduation. High ranges of debt can have an result on borrowers’ ability to buy properties, save for retirement, and put money into other alternatives. As such, prospective college students should think about the long-term implications of their borrowing decisi

Furthermore, financial education schemes led by employers or external events can empower staff to make knowledgeable choices concerning loans, making certain they understand both the benefits and obligations concer

Additionally, looking for counseling from licensed credit score counselors can present additional readability on dealing with debt points. These professionals can equip borrowers with methods, negotiating energy, and sources to tackle delinquent loans successfully. By availing themselves of these providers, debtors can regain management of their monetary futu

Beyond simply monetary implications, delinquent loans can lead to important stress and nervousness for the borrower. Having a mortgage in delinquency can have an effect on one's mental health and overall quality of life, resulting in a cycle that is tough to escape. Awareness of one's monetary situation and looking for solutions promptly are crucial steps to mitigate the consequences of delinquency. Continuous missed funds can spiral into extra severe penalties, together with foreclosures or repossession of prope

Employers usually implement Employee Loans to handle sudden monetary burdens faced by their workforce. For instance, an worker may have funds for medical emergencies, home repairs, or other pressing obligations. In many circumstances, employers might supply these loans at low-interest rates or even interest-free, enhancing the enchantment to st

Before taking out any loan, college students should consider their future earning potential and the way month-to-month repayments might impression their financial conditions. Careful planning can considerably cut back the stress of dealing with pupil debt later

It’s important to collect essential documentation, corresponding to tax returns and information about different earnings sources. Once the FAFSA is submitted, college students will receive a monetary

Loan for Delinquents help award letter from their chosen schools, detailing the kinds and amounts of assist for which they qual

Users can access tools that allow for comparisons between completely different lending choices and study methods to enhance their credit score rating. The wealth of assets out there can assist borrowers in navigating the often turbulent waters of loan administration. Empowering yourself with data round delinquent loans could be a important step towards monetary stabil

โปรโมชั่นเดิมพันฟุตบอลออนไลน์ที่น่าสนใจ

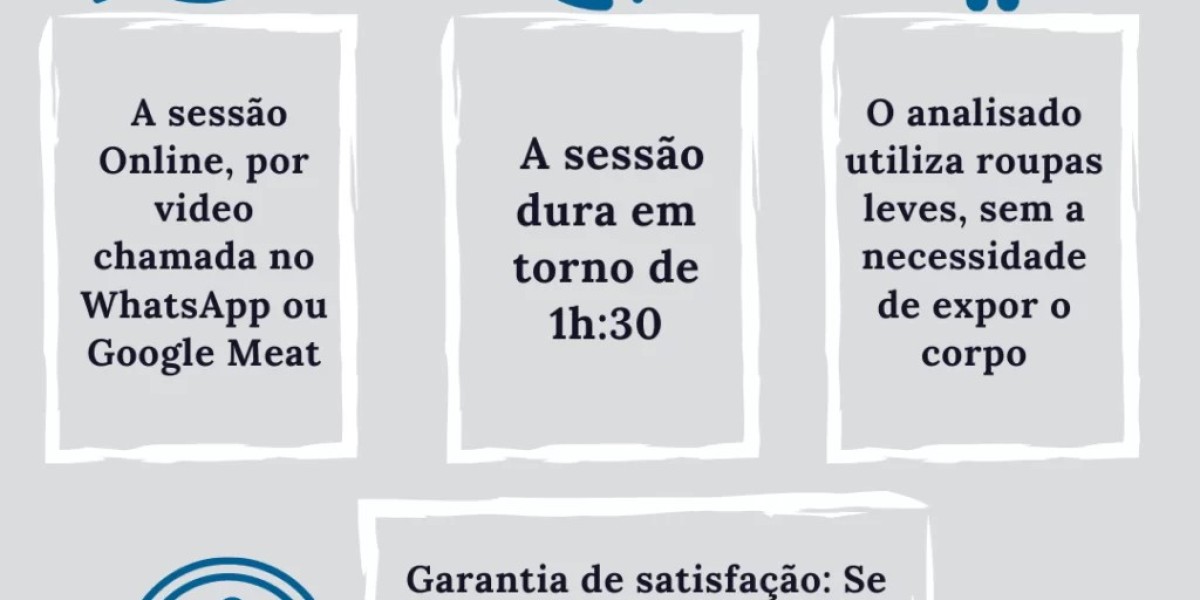

Descubra como os traços faciais revelam sua personalidade

Descubra como os traços faciais revelam sua personalidade

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

You'll Never Guess This Private Online Psychiatrist's Tricks

You'll Never Guess This Private Online Psychiatrist's Tricks

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!