You're checking if SR22 insurance is transferable, considering SR22 requirements, you'll find it's typically tied to a vehicle, affecting SR22 costs, so you'll need to re-file when switching vehicles.

You're checking if SR22 insurance is transferable, considering SR22 requirements, you'll find it's typically tied to a vehicle, affecting SR22 costs, so you'll need to re-file when switching vehicles or states. personal automobile liability insurance polic

You're checking SR22 coverage and driving restrictions, you can't drive other cars without verifying they're covered, as SR22 insurance typically follows you, not the vehicle, imposing specific driving restrictions. personal automobile liability insurance polic

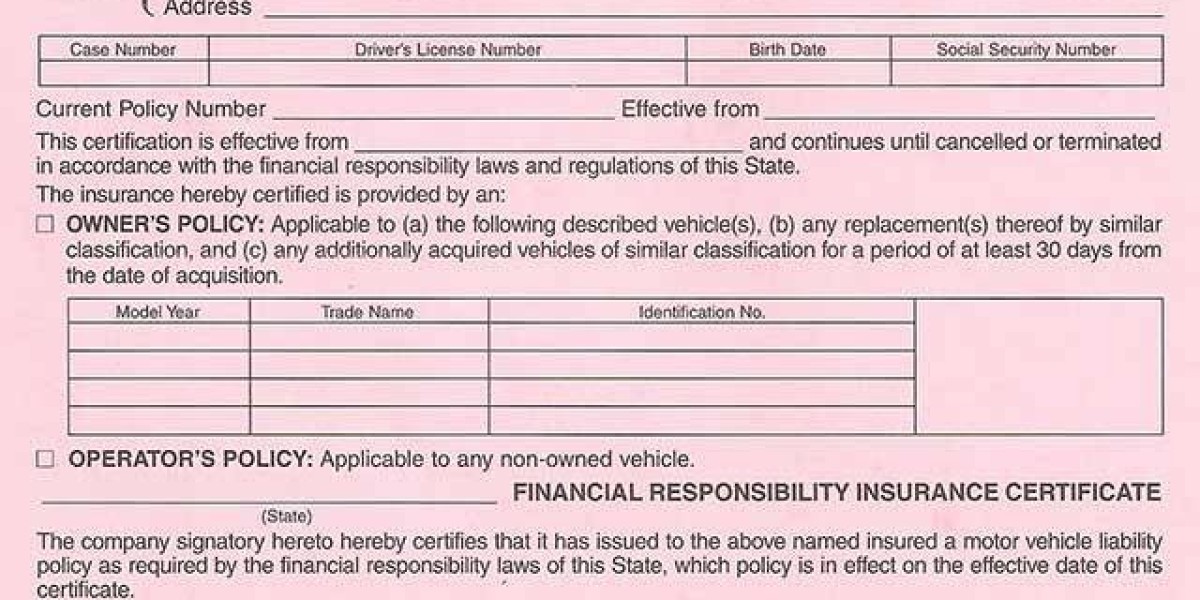

Throughout the filing process, it's crucial to verify the accuracy (Economical Sr22 Coverage Tennessee) of the submitted documents to avoid delays or rejection. Your insurer will typically handle the document submission electronically, streamlining the process and reducing the risk of errors. Once the filing is complete, you'll receive confirmation from the Department of Motor Vehicles, indicating that your SR22 insurance is active and you're in compliance with Tennessee's regulations. By following these steps, you can guarantee a smooth filing process and maintain the required SR22 insurance covera

You're wondering if SR22 insurance covers other drivers, but first, you must check SR22 coverage details, as they dictate other driver liability, which varies greatly depending on circumstances. (%anchor_text

Comparing rates from different providers saves money.

Higher deductibles reduce SR22 insurance premiums.

Annual payments are often cheaper than monthly.

Discounts are available for safe driving courses.

Lowering coverage limits can decrease insurance rate

You've taken the first steps towards reinstating your driving privileges, and now it's time to focus on choosing the right coverage for your SR22 insurance in Tennessee. When selecting a policy, you'll need to take into account different coverage types, including liability (personal automobile liability insurance policy), collision, and all-encompassing. It's important to understand what each type covers and how it applies to your situati

You can't cancel SR22 insurance anytime, as it requires a formal SR22 cancellation process, understanding SR22 insurance implications, and notifying authorities to avoid penalties and guarantee safety compliance (Economical Sr22 Coverage Tennessee). personal automobile liability insurance poli

n SR22 Form

Proof of insurance

$25-$50

License Reinstatement

Fee for reinstating license

$50-$100

Insurance Premium

Monthly premium payment

$100-$300

Driving Course

Optional defensive driving course

$50-$100

Filing Fee

Fee for filing SR22 form

$10-$

Research multiple providers to find the best fit for your needs

Analyze rate comparisons to identify the most cost-effective option

Review policy details to ascertain you're getting the coverage you need

(insurance carriers)

Finding Cheap Rat

You're checking insurance requirements, and you'll find SR22 isn't always needed for motorcycle coverage, but it depends on your state's laws and specific driving circumstances, affecting your insurance options. - Understanding SR22 insurance in Tenness

You're wondering if SR22 insurance covers other drivers, but first, you must check SR22 coverage details, as they dictate other driver liability, which varies greatly depending on circumstances. (%anchor_text

Most Tennessee drivers who need SR22 insurance - insurance carriers must comply with the state's specific laws and regulations. You'll need to understand Tennessee regulations regarding SR22 insurance to guarantee you're meeting the requirements.

Economical Sr22 Coverage Tennessee.

The state of Tennessee mandates that drivers who've had their licenses suspended or revoked due to certain offenses must file an SR22 form with the state department of motor vehicles. This form verifies that you have the minimum required state insurance covera

You'll need to understand Tennessee's insurance requirements and shop around for competitive rates to get cheap SR22 insurance. You're required to have minimum liability coverage and uninsured motorist coverage. Economical Sr22 Coverage Tennessee. You can compare rates from various providers and evaluate discount options - Understanding SR22 insurance in Tennessee, such as good driving records or completion of defensive driving courses. By taking advantage of these discounts and carefully reviewing coverage selections, you can find affordable SR22 insurance options that meet your needs, and exploring these strategies further can help you make an informed decisi

You're flooded with options, you can get SR22 online through countless providers, meeting SR22 requirements via simple online applications that don't take forever, isn't that a huge relief, you'll save time. - personal automobile liability insurance poli

Tennessee's high-risk drivers (insurance carriers), including those with suspended or revoked licenses, typically face strict insurance requirements and higher premiums. You'll need to find affordable SR22 insurance options that meet the state's requirements. As a high-risk driver, you're regarded as more likely to be involved in an accident, which increases the risk for insurance provide

โปรโมชั่นเดิมพันฟุตบอลออนไลน์ที่น่าสนใจ

Descubra como os traços faciais revelam sua personalidade

Descubra como os traços faciais revelam sua personalidade

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

Who Is Responsible For A Free Standing Electric Fireplace Budget? 12 Ways To Spend Your Money

You'll Never Guess This Private Online Psychiatrist's Tricks

You'll Never Guess This Private Online Psychiatrist's Tricks

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!

A List of 50 Super Healthy Foods: Transform Your Health with These Power-packed Foods!